When acquiring a new skill, learning the basics is the first step towards mastery. From there, applying base-layer knowledge to grasp intermediate and advanced topics allows for a more rich and nuanced understanding of any discipline. For crypto traders, this can mean incorporating a wider array of techniques and strategies into their toolkits that go beyond the direct exchange of assets. Where Limit and Stop orders are fundamental to buying and selling crypto, other types can be deployed to mitigate risk under specific market conditions.

In this piece, we’ll examine how advanced order types can help navigate market fluctuations, and explore the different circumstances where they could be used to enhance your crypto journey.

Stop Loss

In the crypto ecosystem, markets never sleep. This can be a source of anxiety for traders with open positions: when every price fluctuation could signal the next bull run or bearish contraction, there’s pressure to remain vigilant at all times. Thankfully, traders can apply Stop Loss order types to their positions in an effort to mitigate potential risk.

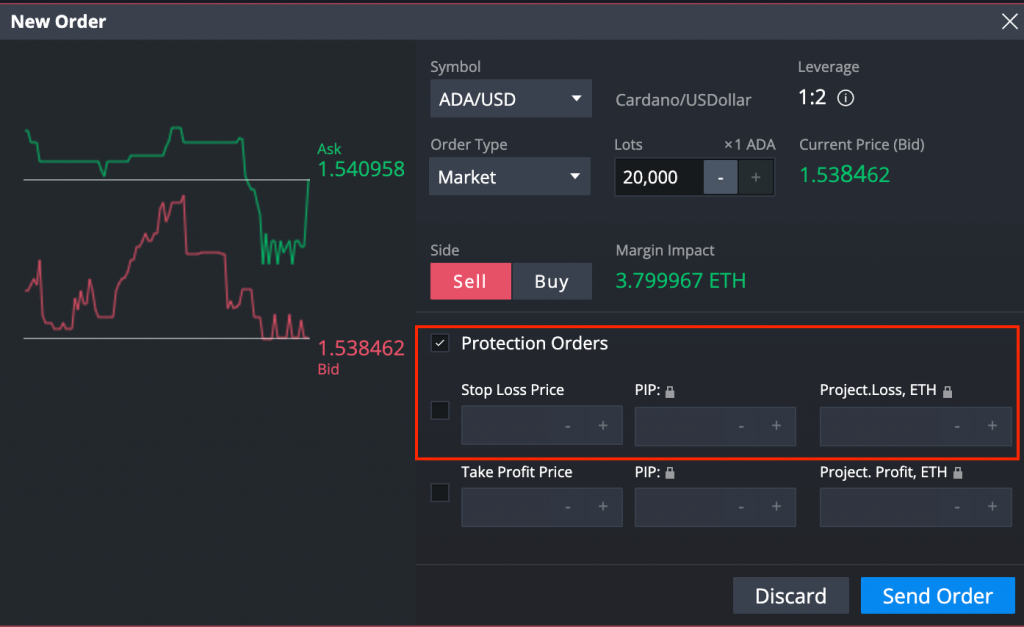

A Stop Loss is designed to limit a trader’s potential for loss if the price suddenly trends against their position. When applied, a Stop Loss will activate and liquidate a trader’s position once the asset price crosses a predetermined threshold. Since traders are required to set their own Stop Loss parameters for each position, this order type can be adjusted to accommodate any risk appetite. However, assets experiencing frequent price turbulence can prove less ideal candidates for this order type.

Stop Loss and Short position

Oftentimes, using specific order types in combination with different trading strategies can yield more precise outcomes. For instance, setting a Stop Loss on a Short position can help insulate traders from the risk associated with a sudden price surge. By placing a Stop Loss just above the current market price, traders can rest assured that their Short position will be less likely to invert into asset loss or debt.

Let’s say the current market price for BTC is $24,000 and a trader wants to open a position to sell 0.1 BTC. However, the market is volatile, so this trader adds a Stop Loss set at $24,500. In this scenario, if the market price climbs instead of going down, the trader’s position will be closed once it reaches $24,500. Once the price hits this threshold, the trader’s Stop Loss will be triggered, and close their Short position. This attempts to cap the trader’s losses at $50, but it’s important to remember that any potential slippage could result in further damages.

Stop Loss and Long position

For Long positions, Stop Losses can also help protect traders when asset prices enter a downward trend. Taken with what we learned about Short positions, a Stop Loss can be an essential defense against runaway price movements in either direction when thoughtfully applied.

For example, let’s say a trader wants to open a Long position and buy 0.1 BTC at a current price of $24,000. To limit possible losses, this trader decides to set a Stop Loss at $23,500. Much like the above scenario, the Stop Loss will trigger once the price reaches this predetermined threshold, and close their position. Again, the trader’s aim here is to cap their losses at around $50. However, extraneous market realities, like slippage, can interfere with this goal, and result in further, unanticipated losses.

Trailing Stop Loss

Building off the capabilities outlined above, a Trailing Stop Loss can be programmed to adjust itself to match market conditions as they develop. This order type can be set to any number of “pips” or percentage point distances from the original asset price. As such, this allows the trader to enjoy all the benefits of a Stop Loss, with the added boost of ratcheting their position to lock in gains on any upward movements.

For example, let’s say a trader wants to buy Bitcoin at $24,000 with a Trailing Stop Loss of 200 pips. This means that the original Stop Loss is $23,800. If the price goes up and reaches $24,200, the Trailing Stop Loss will automatically adjust to $24,000, ensuring the trader at least breaks even. However, if the price were to abruptly drop back to $24,000 after its climb, the Trailing Stop Loss will trigger at the new adjusted price, and close the trader’s position.

While Stop Loss orders are highly customizable, market realities can derail even the most carefully laid plans. In the end, it’s impossible to protect against all potential risk. Therefore, it’s important to understand the limitations of using this family of order types. Remember, abrupt price spikes and liquidity shortages should always be factored in when making any personal risk assessment.

Take profit

At the risk of sounding like a broken record: the crypto ecosystem is volatile. Gains and losses can accrue and evaporate in a matter of seconds. In such a dizzying environment, how can traders expect to find the peace of mind necessary to step away from their terminals? Thankfully, Stop Losses are just one example of protective order types that can help lock in earnings, and adjust to emerging market realities.

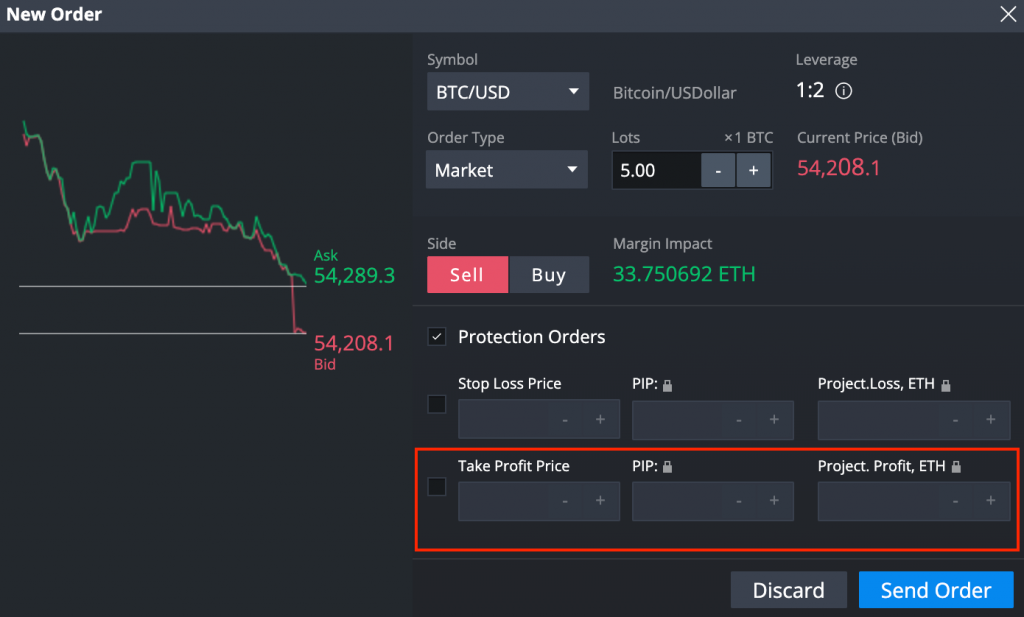

Take Profit orders can be applied to an open position and are designed to lock in gains automatically when an asset’s price reaches a predetermined level. Once that threshold is crossed, the Take Profit order closes the position; if all goes according to plan, the trader will have secured a net gain from the desired parameters of the order.

Take Profit and Short position

Like the Stop Loss examples above, Take Profit order types can be applied to Short positions to help lock in gains. However, take note of the different metrics each order type relies on to trigger closures. Since each type is designed to accommodate a different market condition, it’s important to grasp these nuances before funds or assets are on the line.

Let’s say a trader, after careful research, opens a Short position for 0.1 BTC with a market price of $24,000. In anticipation of the price trending down, the trader sets the Take Profit level at $23,500. Now, here’s an important distinction to keep in mind. Unlike Stop Loss orders, which respond to market price thresholds, Take Profit orders trigger once the Ask price of an asset reaches the specified threshold. Then, the Take Profit order will close the trader’s Short position, and lock in a $50 profit.

Take Profit and Long position

Similarly, Take Profit order types can be paired with Long positions to an equal degree.

Imagine the current market price for 1 BTC is $24,000, and a trader would like to buy 0.1 BTC. After careful research, this trader thinks the price could be poised for an uptrend. With their eyes set on a $500 gain, the trader opts to set a Take Profit order for $24,500. Much like with Short positions above, Take Profit orders respond to the Bid rather than market price. That being said, if the Bid price climbs to $24,500, the Take Profit order will trigger, closing the Long position. In turn, this secures a $50 profit for the trader.

However, it is important to understand the limitations of setting Take Profit thresholds. Namely, that aiming too low can result in underwhelming returns should prices enter a bull run. While this isn’t to say that these trades weren’t successful. Rather, this aside is meant to illustrate the opportunity costs of automated trading.

Trailing Take Profit

Much like its counterpart above, Trailing Take Profit orders employ a similar logic in their resolution, but with some key differences. For starters, Trailing Take Profit orders activate only after initial Take Profit thresholds have been met. This ensures that, once the predetermined value has been reached, traders can enjoy any additional gains without the risk of downward trends erasing their profits. However, unlike Trailing Stop Loss orders which help insulate against negative price movements, Trailing Take Profit orders establish their protection only after profits have been secured. This allows strategic participants to enjoy the best of both order types.

For example, say a trader wants to open a Long position and buy 0.1 BTC at $24,000 with a Take Profit order set at $26,000 and a 2% Trailing Take Profit. In this scenario, if the price goes to $25,000, the Take Profit order will remain active until it reaches the $26,000 threshold. In fact, even if the price meets or surpasses that value, the position remains open to prop the door open for additional gains. That way, traders have the opportunity to react to aggressive movements without putting their newly accrued profits on the line.

Imagine the price then marches to $29,000, establishing a new threshold. Now, the Stop order automatically adjusts to $28,420, which is 2% away from the new Take Profit high. If the price reaches that new value, the Stop order will execute, closing the position. Where a regular Take Profit order would have executed at $26,000, the Trailing Take Profit parameters completed at $28,420, showing a better performance. However, please note that these added benefits still depend on shifting market conditions and available liquidity. Such concerns should always be factored in when participating in the crypto ecosystem.

Good ‘Til Cancelled (GTC)

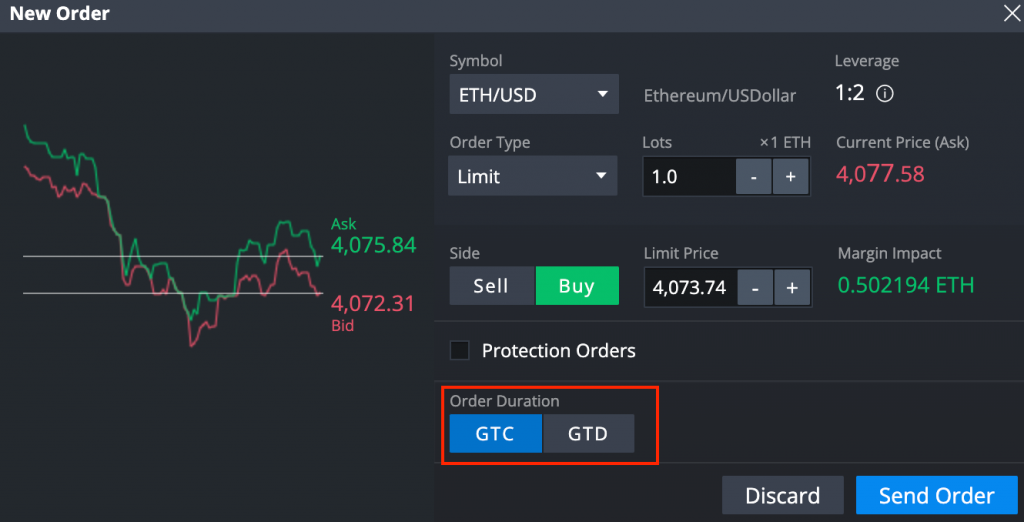

As the name suggests, a Good ‘Til Cancelled (GTC) order will remain active either until it is filled, or the trader cancels the order (get it?). While these give users greater control over how they structure their movements, it also puts the onus entirely on the individual to manage their positions.

Unlike some of the previous order types we’ve discussed, GTC are usually deployed by traders who are comfortable letting the markets unfold. Since there are only two potential routes for closure, users have greater freedom to retract their positions with less fear of potential risk. When combined with Limit or Stop orders, GTCs can be customized for enhanced precision.

For example, let’s say a trader wants to place a Limit order to buy ETH for $3,500 when the market price is $4,000. The market price is trading above $3,500 for several weeks, so the user keeps their order open. Once the market price drops to $3,500, the trader’s buy order is executed.

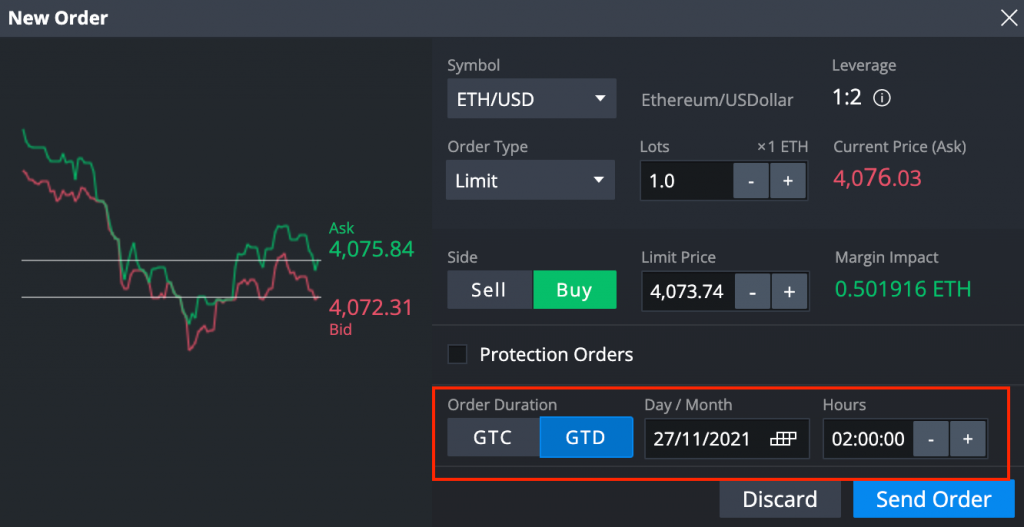

Good Till Day (GTD)

Similar to its aptly named cousin above, a Good Till Day (GTD) order remains active in the market until a specified date, or until it becomes fulfilled or cancelled. This order type allows traders to set up an expiration date for their positions, often in tandem with Limit or Stop orders, for improved accuracy.

For example, a trader wants to buy 0.1 BTC at the $24,000 BTC price before the end of a month. A limit order can be placed at $24,000, while a GTD instruction is given to cancel the order if it’s not executed by month’s end. That way, the order will only be filled if it reaches the predetermined price before the scheduled time. Otherwise, it will be cancelled.

Both GTC and GTD orders are known as “time in force” orders since they define the length of time an order will be active before its execution.

One-Cancels-the-Other (OCO)

For traders looking to combine two orders, such as Limit and/or Stop, into one action, One-Cancels-the-Other (OCO) orders help make this possible. While they require more parameters to execute, this order type gives traders more flexibility to potentially maximize profits and/or mitigate losses. In a nutshell, two orders are placed simultaneously above and below the current market price. Then, when one of them is filled, the other is automatically cancelled.

For example, let’s say the current ETH price is $4,000. After conducting careful research, a trader decides to place an OCO order to hopefully capitalize on one of two possible outcomes. Thinking the ETH resistance level is hovering around $4,100, the trader places a buy at that price, and a short position at $3,900, the current support level. In this scenario, the trader has two potential ways to earn a profit on these positions. And the kicker: once either outcome is met, the other is immediately cancelled.

One-Triggers-the-Other (OTO)

Unlike the above, One-Triggers-the-Other (OTO) orders can be used to initiate a second function, but only when the parent order has been triggered. Essentially, OTO orders allow traders to program Take Profit and Stop Loss levels in anticipation of a potential price movement.

Let’s say ETH is trading somewhere around $4,000, and a user believes that once the price hits $4,100, it will fall back to $3,900 shortly after. To take advantage of this potential outcome, the trader places an OTO order with a Limit order to sell at $4,100 as its first action. This is the parent order. In turn, a Stop order to buy at $3,900 is set.

Once the price reaches $4,100 and the parent order triggers, the second order will be placed to buy at the lower price. However, if the price does not reach $4,100 and the parent order is not triggered, the second order will not be placed. Both OCO and OTO orders are known as conditional orders since they include one or more specified criteria.

Where to use advanced order types

Now that we’ve unpacked some of the various advanced order types and how they work, it’s time to think about putting our new found knowledge into practice. Long time CEX.IO users are likely familiar with our legacy Exchange, which helped pioneer BTC’s accessibility for crypto curious participants. Now, our new Exchange Plus platform builds on that success with the inclusion of advanced order types like Stop Limit, Good till Date, and Immediate or Cancel, backed by institutional grade liquidity. Verified CEX.IO users can create up to five (5) sub-accounts on Exchange Plus to experiment with different trading strategies, and find their own unique path through the crypto ecosystem.

Looking for more crypto knowledge? Explore more articles and analysis at CEX.IO University, or head over to our product ecosystem to put your skills to use.

Disclaimer: Information provided by CEX.IO is not intended to be, nor should it be construed as financial, tax or legal advice. The risk of loss in trading or holding digital assets can be substantial. You should carefully consider whether interacting with, holding, or trading digital assets is suitable for you in light of the risk involved and your financial condition. You should take into consideration your level of experience and seek independent advice if necessary regarding your specific circumstances. CEX.IO is not engaged in the offer, sale, or trading of securities. Please refer to the Terms of Use for more details.